Empowering Your Purchase: How Flexible Payment Plans Transform the Buyer’s Experience

Published on 2023年 9月 1日 by iartglass

Introduction

In an age where commerce is increasingly digital and global, one of the most pivotal shifts we’ve seen is in the realm of flexible payments. These are payment methods that aren’t just a simple one-off transaction. They provide options, adaptability, and most importantly, empowerment to the buyer. Today, the buying power lies not just in the wallet, but in the choices consumers have in how they wish to pay.

Historically, buyers were limited to a narrow range of payment options. Today, Siga Art Glass and many other forward-thinking companies recognize that consumer purchasing patterns are evolving. Consumers now expect a personalized shopping experience that aligns with their financial comfort and needs.

Understanding Flexible Payments

What Are Flexible Payments?

At its core, a flexible payment is any payment method that offers the consumer a choice in how, when, or in what increments they pay. This could range from monthly installment plans to deferred payments kicking in a few months after the purchase.

The origin of such payment structures isn’t entirely new. Consider the age-old “layaway” plans, where buyers would reserve an item and make periodic payments until the full price was met. However, the modern incarnations of these plans, backed by technology and broader financial infrastructures, offer far more versatility and convenience than ever before.

The Technological Revolution

The evolution and adoption of flexible payments wouldn’t be possible without technology. With the rise of e-commerce and digital marketplaces, businesses required innovative solutions to meet the varied demands of a global consumer base.

- Digital Platforms & Integrations: Platforms like Shopify or WooCommerce integrate payment gateways that allow for easy installment plans or deferred payments.

- Real-time Credit Checks: Instantaneous credit checks allow businesses to approve consumers for financing in seconds, making the checkout process smooth.

- Automated Billing Systems: These systems can auto-debit accounts, ensuring businesses receive their payments and consumers don’t default inadvertently.

Moreover, the widespread use of mobile devices has further streamlined the payment experience. With a few taps on a smartphone, buyers can choose their preferred payment method, adjust their installment amounts, or even defer a payment if necessary. The experience that companies like Siga Art Glass offer ensures that both the artisanal value of products and the flexibility of modern commerce go hand-in-hand.

Why Buyers Love Flexible Payments

The consumer-centric world of modern commerce demands adaptability, and with flexible payments, buyers get precisely that. But why has there been such a significant gravitation towards this payment model? Let’s dive into some reasons:

1. Enhancing Buying Power

Flexible payments effectively augment a buyer’s purchasing power. They’re no longer constrained by what’s immediately available in their bank account. By spreading payments over a period, consumers can invest in higher-quality products, like the exquisite hand-blown glass pieces by Siga Art Glass, without the pressure of a hefty one-time expense.

2. Catering to Individual Financial Situations

Not every buyer’s financial situation is the same. While some may prefer to pay upfront, others might find it more feasible to distribute their payments. Flexible payment options allow for this personalization, ensuring that buyers can choose a plan that aligns seamlessly with their budgetary constraints and cash flow patterns.

3. Increasing Purchasing Confidence

There’s undeniable confidence that comes with choice. When buyers know they have the flexibility to adjust payments based on unforeseen financial situations, it increases their willingness to commit to a purchase. This assurance is especially crucial for more significant investments or artisanal products where the value is inherent in the craftsmanship, such as the artistry evident in every curve of Siga Art Glass creations.

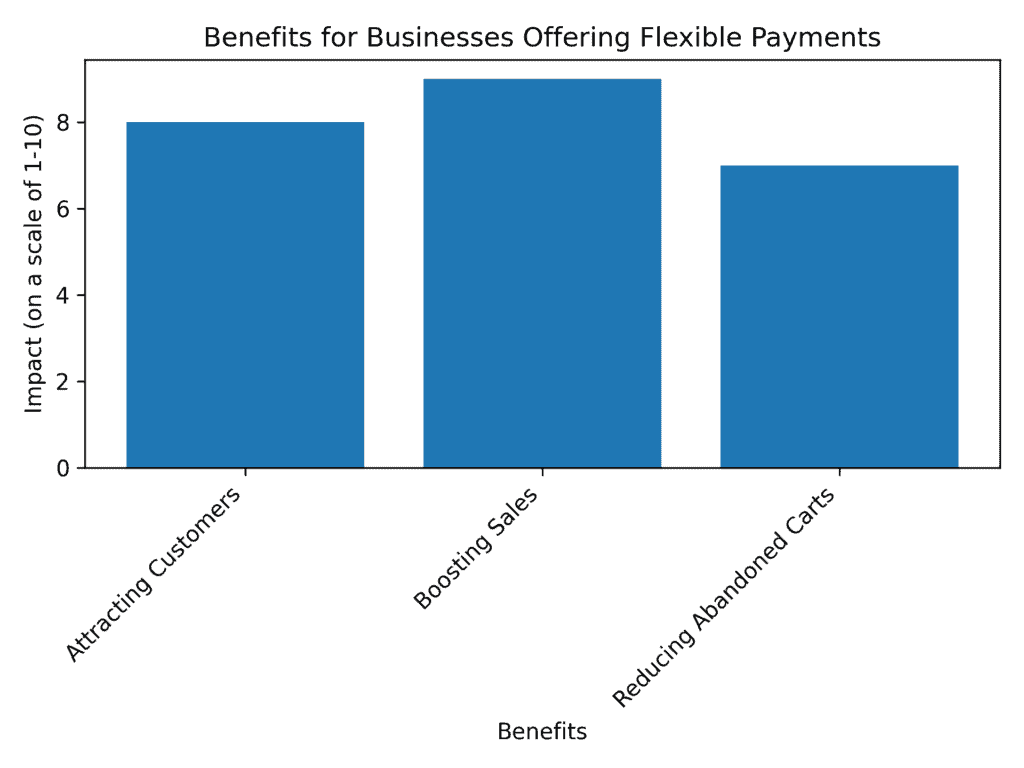

Benefits for Businesses

While the advantages for buyers are clear, businesses too stand to gain immensely from offering flexible payment solutions. Here are the key benefits:

1. Attracting a Broader Range of Customers

By offering a spectrum of payment options, businesses can cater to a wider demographic. Whether it’s a college student looking to purchase a beautiful hand-blown glass pendant over a few months or a collector willing to pay upfront, there’s something for everyone.

2. Boosting Sales and Customer Loyalty

Flexible payments can be a decisive factor for many consumers on the fence about a purchase. By providing them the financial flexibility they seek, businesses not only increase the likelihood of a sale but also foster a sense of goodwill and trust. Over time, this trust translates to loyalty, with customers more likely to return to brands that accommodate their financial needs.

3. Reducing Transaction Friction and Abandoned Carts

One of the most significant challenges online retailers face is cart abandonment. A primary reason for this is the lack of suitable payment options. By introducing flexibility in payments, businesses can significantly reduce this friction point, ensuring that customers complete their purchases without second thoughts.

Different Types of Flexible Payment Options

In today’s commerce landscape, buyers aren’t limited to a one-size-fits-all payment model. The era of paying only through lump sums or strict credit terms is behind us. Instead, an array of flexible payment options cater to varying financial needs and purchasing preferences. Here’s a breakdown of the most prevalent options:

1. Installment Plans

These are predetermined payment plans where buyers pay for their purchases in regular installments over a set period. It’s especially useful for high-ticket items, enabling consumers to distribute the cost over several months or even years.

2. Buy Now, Pay Later

A relatively newer trend, this option allows customers to purchase and receive items immediately but defer the payment to a later date, often without any interest if paid within a specific period.

3. Layaway

A more traditional method, layaway allows consumers to reserve an item by paying a fraction of its cost.

They then continue to make periodic payments until the full price is covered, after which they can take the item home.

4. Deferred Payments

Similar to “Buy Now, Pay Later,” deferred payments let consumers delay the payment for a set time after the purchase. It’s particularly beneficial for those who are awaiting funds or prefer to manage their cash flow better.

5. Rentals and Lease-to-Own Options

For items that might be needed temporarily or for those who’d like to test a product before fully committing, rentals offer a solution. Lease-to-own takes it a step further, allowing consumers to rent with the option to purchase the item at the end of the lease term.

Highlight: Siga Art Glass Embraces Flexible Payments

In the realm of artisanal craftsmanship, few brands exemplify the balance between tradition and modernity like Siga Art Glass. Recognizing the importance of aligning with current commerce trends, Siga Art Glass has seamlessly integrated flexible payment options into their business model.

Adapting to the Trend

Embracing change is crucial for businesses to thrive, and Siga Art Glass’s decision to offer varied payment options is testament to their commitment to customer satisfaction. Whether it’s a collector looking to acquire a masterpiece from their collection or a homeowner aiming to add a touch of elegance to their decor, there’s a payment plan tailored to suit every need.

Success Story

While specific testimonials further cementing Siga Art Glass’s success with flexible payments would be invaluable, one doesn’t need to look further than their expanding clientele and the buzz in the industry. Their ability to merge the age-old craft of hand-blown glass artistry with modern purchasing preferences speaks volumes about their vision and adaptability.

Challenges and Considerations

While the benefits of flexible payments are undeniable, like every financial model, they come with their set of challenges. Here are some critical considerations businesses need to address:

1. Addressing Potential Drawbacks

While flexible payments enhance buying power and facilitate high-ticket purchases, there’s also the risk of consumers overextending themselves. Businesses need to ensure transparency in their payment terms and avoid hidden fees that can exacerbate financial strain on the consumer.

2. Educating Consumers

Understanding the terms of a payment plan, the duration, any interest rates, and potential penalties is vital. Businesses must play an active role in educating their customers, ensuring they make informed decisions.

3. Staying Compliant with Financial Regulations

Flexible payment options often bring a myriad of financial regulations. Whether it’s interest rates, credit checks, or data protection, businesses need to be diligent about compliance to safeguard both themselves and their customers.

Looking Ahead: The Future of Flexible Payments

The world of commerce is evolving rapidly, and the payment industry is no exception. Here’s a glimpse into what the future might hold:

1. Predictions and Trends in the Payment Industry

The shift towards digitization is only expected to intensify. Cryptocurrencies, digital wallets, and even AI-driven financial advisors might play a more prominent role in how consumers choose to pay.

2. The Ongoing Shift towards a More Digital and Flexible Economic Landscape

As technology continues to infiltrate every facet of our lives, the demand for convenience and flexibility will only grow. Businesses that fail to adapt risk being left behind, while those who embrace the change, much like Siga Art Glass, will set the standard.

Conclusion

The rise of flexible payments isn’t merely a trend—it’s a testament to the evolving needs of modern consumers. As purchasing patterns shift and technology continues to redefine boundaries, understanding and integrating flexible payments isn’t just an option; it’s a necessity.

For businesses, it’s time to recognize and adapt, providing customers with the choices they seek. And for consumers, the world of commerce has never been more accommodating. So, whether you’re looking to purchase a timeless piece of hand-blown glass or any other product, take advantage of the myriad of payment options at your fingertips.

Embrace flexibility, embrace the future.